Tether’s hold on Bitcoin’s liquidity: A risk assessment

From Hasu and Sylvain Ribes

In this piece we demonstrate how several recent reports about Bitcoin’s exposure to Tether have been grossly exaggerated. We then assess how exposed to both solvency and liquidity risks is Tether. We finally conclude that Bitcoin should be robust to Tether-related shocks.

I — Introduction

A “tether” is a dollar-pegged digital token that exists on the Omni Protocol (an extension of the Bitcoin blockchain). One unit of “tether” (USDT) is created by sending $1 to Tether Limited, where it is held in full reserve as long as the corresponding USDT token is in circulation. Thus people have the ability to redeem their USDT tokens for the same amount of dollars, and USDT consistently trades at $1 on the market.

Unlike the actual USD backing it, tethers can be stored, sent and received globally and securely with an hour.

Understated utility…

At its core, Tether makes it much easier for cryptocurrency exchanges such as Binance or Bitfinex to exist outside of KYC/AML regulations by allowing them to support fiat-like currency pairs. A majority of people around the world either do not trust the US or simply cannot get access to the US banking system. To these people and jurisdictions, Tether gives access to a more flexible version of the US dollar, and is a tremendous asset.

The story of Tether to date has been one of success. Within two years it has grown from storing less than $10M to almost $2.8B in value. Being listed on virtually every exchange, it enjoys massive network effects and the market trust in its convertibility has remained quasi absolute throughout its history. Which demonstrates two things:

- There is a strong natural demand for storing and moving stable value on the blockchain

- People are willing to take on the involved centralization risks in return for convenience

Exchanges, OTC brokers and arbitrage shops, who all provide valuable liquidity to the cryptocurrency ecosystem, are Tether’s main customers.

… but a highly publicized risk

At the same time, Tether is seen by many as a liability and structural risk to this space. Among other things it has been accused of being a Ponzi scheme, being printed out of thin air and generally run as a fractional reserve. A recent article from the Wall Street Journal once again put the spotlight on Tether by claiming that “at times this summer, Tether has represented as much as 80% of Bitcoin trading volume”, calling it a systemic risk for the entire crypto space. To support this claim they indirectly rely on data provided by CoinMarketCap which, at the time of writing, showed Bitcoin trading volume to be made up of 62% USDT (Tether), 33% USD and 5% EUR.

We believe the view of Tether as a liability to be at odds with the value it creates and the important role it takes on in the space, and decided to dig deeper.

II — Gauging actual Tether liquidity

An alternative to volume reporting

Self-reported trading volumes as reported on CoinMarketCap have been shown to be chronically unreliable (1, 2, 3). Exchanges such as OKex or Huobi are infamously known to inflate their volumes by as much as 90%. Even Binance, the number one Bitcoin exchange by volume, regularly comes under scrutiny. Lately, CoinMarketCap has taken a turn for the worse and is increasingly listing exchanges whose traffic is entirely fictitious with the likes of Bitforex, ZB, Coinsuper, and so many more.

Under these conditions, assessing liquidity based on volume figures sampled from CoinMarketCap is at best lazy, at worst dishonest, and in any case unworthy of any serious outlet.

A much more reliable measure of liquidity is, well… liquidity, as offered directly by exchange orderbooks. Compared to self-reported volume, which can be easily inflated, orderbooks usually do not lie. An exchange attempting to fake its orderbooks would most likely quickly get caught: whenever a trader would try to fulfill the fake order he’d realize his order had been only partially filled or his expected execution price is way off. Eventually, traders would figure they’re being front-run or orders are altogether fake. To the best of our knowledge, no significant reports of fake orders have ever been recorded (while orderbook spoofing undoubtedly occurs, it would still qualifies as liquidity since the spoofed orders can in practice be matched).

We thus set out to download the current orderbook data from all well-known exchanges, aggregated it into a global orderbook and narrowed it down to all orders that were within 2% of the current market price. All the presented data (available here) has been sampled on an 8-hour period on the 26th of August, and its consistency over time has been verified several times since. The result paints a much more accurate picture of the liquidity available to potential buyers and sellers at a given time.

Results

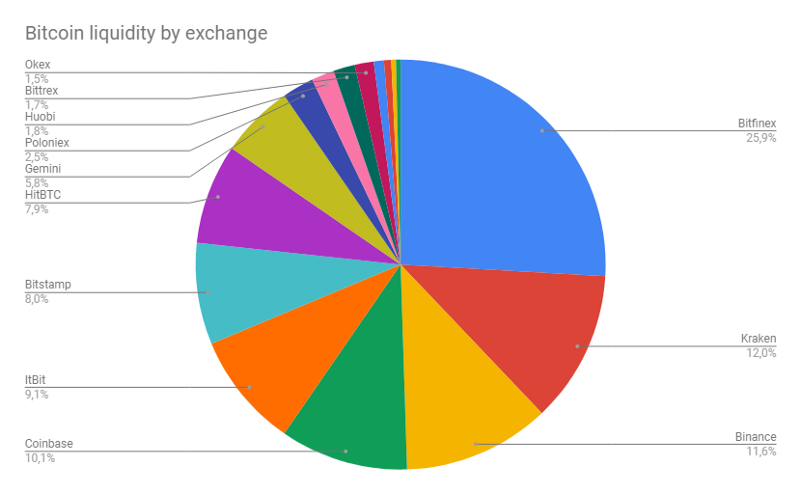

We chose to assess Bitcoin’s exposure, not only to the currencies for which it trades, but also to the platforms on which it is exchanged.

Bitfinex comes off as the clear leader in the exchange race, ahead of a cohort of rather evenly matched competitors. There is no definite monopoly in Bitcoin’s liquidity as there might have been in the early days of Bitcoin’s financialization, when MTGox was thought to handle as much as 70% of the global volume, leading to the seismic events of 2014.

Notice that we chose not to include KRW or other local currencies. While KRW and JPY would most likely have accounted for at least 10% of the global liquidity, data from Korean and Japanese exchanges is not sufficiently readily available for us to be confident in our numbers. Other fiat pairs would be but a blip on the chart.

With this caveat, we find that USDT makes up for only 29% of Bitcoin’s liquidity while USD makes up for 57% and EUR for 14%. USDT’s influence is, in reality, a far cry from the 80% (WSJ) and 62% (CMC) figures.

29% is nevertheless a sizeable proportion, and a variety of considerations should come to mind when assessing how much of a liability Tether could become if it were to face a crisis. First and foremost, the prominence of the closely associated exchange, Bitfinex.

III — Assessing Tether risk factors

Bitfinex and Tether

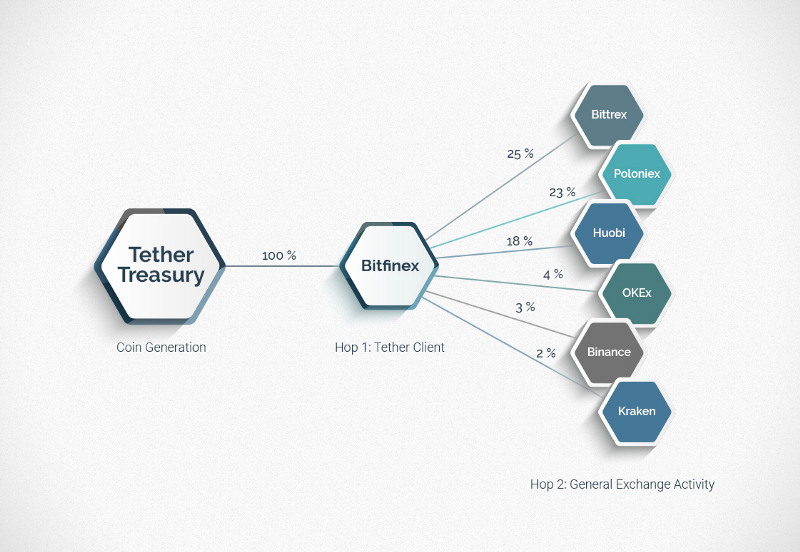

We should first highlight how tightly intertwined Bitfinex and Tether are. Indeed, they have the same owners, reportedly the same banking relationship and 100% of the newly issued USDT transit through Bitfinex.

While 29% of Bitcoin’s liquidity is currently coming from Tether, Bitfinex provides another 26%. It is actually unclear to many whether the listed Bitfinex USD pair is actual USD or USDT. We chose to consider it was the former, which seems fair since they seamlessly allow for USD withdrawals. Yet this close relationship is another risk factor to keep in mind.

The Tether crises

Tether has been described as “the central bank of crypto trading” (WSJ) and “glue that holds together a lot of the $375 billion cryptocurrency market” (Bloomberg). To accurately assess the risk from the Bank of Tether, we will distinguish between two kinds of banking crises.

- A solvency crisis in which the the bank simply cannot pay back depositors for lack of funds

- A liquidity (convertibility) crisis, in which the bank can pay depositors, but doesn’t have all the money at hand immediately

The lingering specter of a solvency crisis

A Tether solvency crisis would have dire consequences for the crypto-ecosystem. Up to 2.8 billion dollars worth of Tether would be rendered worthless, not only representing a very significant capital outflow, but also triggering an extremely strong confidence crisis and a rush to the doors, as most would expect Bitfinex to go down with the Tether ship.

A solvency crisis certainly is on the mind of many concerned investors and crypto-skeptics alike, and many have publicly voiced their concern (1, 2).

However, research by Bitmex and Bloomberg has produced compelling evidence that Tether does maintain a stable banking relationship with Noble bank in Puerto Rico, whose assets are custodied with Bank New York Mellon Corp. Both sources have found that Puerto Rico has seen “an enormous influx of cash related to cryptocurrencies in the past year. The cash and equivalents held by the island’s so-called International Financial Entities such as noble soared to $3.3 billion at the end of 2017 from $191 million a year earlier” (Bloomberg). New financial data with inflows from 2018 (1, 2) has all but confirmed that hypothesis.

We encourage the reader to form their own opinion from the available evidence but in our opinion it all makes a solvency crisis highly unlikely.

A less ominous liquidity crisis

Assuming secured full reserves, Tether could be still be shut down by authorities in the future, or lose their reported banking license with Noble, which could lead to a liquidity crisis. In the most likely and sensible scenario Tether holders would be given a 3–6 month time period to redeem their USDT for Tether Limited’s fiat reserves. As a result, trust in the ecosystem as a whole could temporarily be impaired and many holders of cryptoassets could look to exit their positions, all crowding into the same narrow fiat gates.

However, with a reasonable 29% of Bitcoin’s total liquidity, the disappearance of USDT pairs would certainly not meaningfully disrupt the supply and demand dynamics of the ecosystem. Surely some of the liquidity would immediately spill over to actual fiat pairs, and it is only a matter of guessing how fast a new widely accepted stablecoin would rise from the ashes of Tether.

It is hard to predict what impact Tether being shut down would have on Bitfinex, but it is difficult to believe it would be critical. They are, to begin with, two legally separate companies. Maybe more importantly, Bitfinex is very profitable, enjoys the trust of the largest players and trading desks in the crypto space, and has proven its strong financial resilience following the hack and theft of 120.000 bitcoins in 2016.

A Tether liquidity crisis as described would not in our opinion qualify as a “systemic risk” (an event that would permanently damage the space and set its progress back several years).

IV — Future Outlook

In times when Shapeshift, one of the last exchanges still resisting KYC/AML procedures, is capitulating to US regulation, we see Tether as one of the last heralds of “open finance”. While “the transparency, that some Tether stakeholders seem to expect may not be possible in the financial sector when the underlying activity is not clearly authorized or regulated by the authorities” (Bitmex) we believe it is a tradeoff clearly worth making.

Because of network effects, money protocols either follow a winner-take-all or a power law distribution. For this reason, Tether will prove extremely hard to naturally disrupt, for it has a massive lead on any other stablecoin due to its near impeccable $1-peg track record and liquidity. There are however two ways another stablecoin could disrupt Tether’s network effects. The first, Tether could simply collapse under the weight of regulatory pressures. The second would be to bring a distinct value proposition to the table.

Regulatory compliance may well be one such proposition. On that front, a promising alternative to Tether is TrueUSD, which also works on full reserves but in absolute compliance with US regulations. Its market cap has risen from $0 to in March to $75m today, and is still on the rise, according to sources on trading desks. As the liquidity of TUSD increases, we expect it to take more market share from Tether in the future. Also worthy of note is Circle, the yet unlaunched Bitmain-supported stablecoin.

Because fully reserved stablecoins derive their value from being redeemable for actual USD, these schemes will always bear the risks of centralization. Loosely regulated schemes like Tether face being shut down by authorities, while fully compliant ones like TrueUSD trade this off against stricter KYC/AML procedures, potentially allowing for the blocking of transactions or the freezing of a customer’s funds.

Some projects like Dai or Basis are hoping to create more decentralized stablecoins, but at this point we consider them highly experimental and do not believe they can be serious competitors to the battle-tested, fully reserved model. For an overview of all stablecoin projects, we recommend visiting https://stablecoinindex.com/.

V — Conclusion

In spite of the neverending hubbub surrounding Tether’s emission and unclear backing, it is these authors’ opinion that the threat it poses is vastly offset by the services it renders. Its solvency appears to no longer be in question, and while the public and the media are right to contemplate the possibility of authorities bringing USDT trading to a halt, they should not dread the long term aftermath. In the short run Bitcoin’s price would be strongly affected, but there’s no reason why it should endlessly spiral down.

For indeed Bitcoin’s liquidity is widely distributed beyond USDT, and, as importantly, among exchanges. We’ve far outgrown the MT