The least understood thing about stablecoins is how they come into existence. Who creates the supply of Tether, USDC or Dai that you can buy on your favorite exchange? We will take a look at how professional arbitrageurs expand and contract the supply of a stablecoin based on the current demand of the market, how Dai’s model is different and why the lack of a professional arbitrage model makes Dai fundamentally unscalable.

There’s a common misconception that Dai can scale to any size, as demand for the stablecoin drives the price over $1, which leads arbitrageurs to lock up ETH (or other assets) in CDPs and create more Dai. This chain of logic is usually used to support the narrative that higher demand for Dai leads to higher demand for Ether, but both statements are wrong.

How stablecoins scale

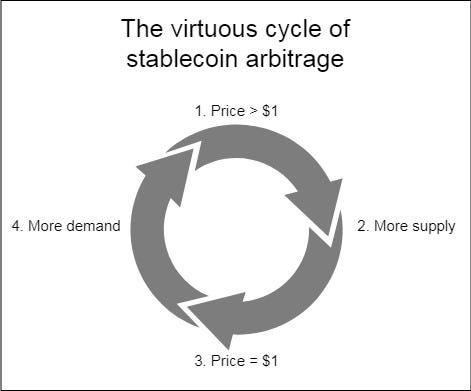

Let us define a stablecoin as scalable if its supply can closely track the demand to hold it. To do that, a stablecoin relies on the existence of professional arbitrageurs that react to market signals and keep supply and demand in a constant balance.

Professional arbitrage requires a closed cycle. The faster and more efficient the cycle can be iterated through, the more closely will supply track demand in either direction. For an example, let us look at a collateralized fiatcoin, Tether (USDT).

When market demand pushes the price of USDT against USD to $1.02, the market signals to the arbitrageur to start working. He sends $1.00 USD to Tether Inc. and receives 1 USDT in return. Since the market currently values USDT at $1.02, it buys him $1.02 worth of USD, for an immediate profit of $0.02. The same is true in the other direction when the price of USDT falls to $0.98. Arbitrageurs will buy up USDT for $0.98 USD, send it to Tether Inc. and redeem it for $1.00 in USD, again closing the cycle with a profit.

Professional arbitrage is impossible for Dai

There is no way to execute a closed cycle for Dai, so it’s much harder to arbitrage. We will demonstrate that by going through a hypothetical arbitrage cycle for Dai.

When market demand pushes the price of DAI to $1.02, you can again take $1.00 USD, buy $1.00 ETH (or any other asset that can be used as collateral) and lock it in a CDP. The problem, however, is that for each $1.00 ETH locked up, Maker will give you less than $1 of Dai. That is due to the requirement for over-collateralization. The current collateralization ratio is 150%, so $1.00 ETH in a CDP can generate up to 0.66 Dai (this ratio could change, but it’s never going to be close to 100%).

Now you can certainly sell the 0.66 Dai at the same 2% premium, but you still have the original ETH locked up. The fundamental difference between “arbing” Tether and “arbing” Dai is that with Dai you also need to look for a profitable way to exit the collateralized debt position at a later date. And it’s only going to be profitable if you manage to buy back the Dai for less than you sold it for.

While you wait for the price of Dai to drop, you are stuck in an unfortunate position:

- You don’t know when, or if, the price of Dai will fall again

- Since you cannot complete all the steps of the cycle simultaneously, you are stuck with long exposure to ETH while you wait. You want to sterilize the risk by shorting ETH, but that incurs an additional borrow cost.

- You have an additional cost of capital for locking up the part of sterilized ETH you didn’t borrow Dai against, which is at least 33% (since you can draw $0.66 Dai for every $1 ETH). The cost of that is the risk-free rate of USD.

- There is an additional cost for closing the CDP.

USDT and other collateralized fiatcoins allow for closed arbitrage cycles because the collateralization ratio is 100% and not higher. Arbitrageurs can create $1 of USDT with $1 of USD, then sell the USDT and be done with it — they no longer have to worry about the USD “locked up” in Tether Inc.’s bank account. Those USD are someone else’s problem now. The existence of committed arbitrageurs allows USDT supply to closely track demand.

We established that Dai arbitrage is very costly, but is there a point where it becomes profitable? The collateralization ratio of ETH and Dai is fixed at 1.5:1, so 1 ETH currently creates 0.66 Dai. If the price of Dai were $1.50 or higher, $1 ETH would create $1 Dai. At this point, you can sell the Dai and forget about it your CDP — just as you would with USDT — except that you even have a free option at buying back your ETH later. So deterministically, pure arbitrage is profitable at $1.50. Probabilistically, it’s going to be profitable below $1.50, but there is no guarantee to close the cycle within a predictable window of time.

Of course, this is purely hypothetical -people are not going to bid Dai up to $1.50, or even $1.10. It’s much cheaper to simply use another stablecoin, or if none existed-say for reasons of regulation — sterilize a volatile asset like ether or bitcoin by shorting it. So the price of Dai, even in a high demand scenario has a relatively low ceiling that will ensure that the professional arb window never opens.

No arbitrage = no scaling

Now one can argue that the same premium will lead to more natural demand for CDPs, resulting in *some* arbitrage, and that is certainly correct. Natural CDP creators will be incentivized to arb the price at the margin, especially those who already have CDPs open and can generate some more Dai at minimal effort. But at every price level, there is still a natural ceiling to the demand for CDPs which doesn’t exist when closed arb cycles are possible.

Why is the natural arbitrage by CDP creators not enough to make Dai scale? Remember, the faster a stablecoin can iterate through this cycle, the more closely will its supply track its demand. The important part for stability is getting the price of your coin up to $1. But the important part for scalability is getting the price back down to $1. Whenever the price is over $1, the demand for buying Dai is very low, since a potential buyer has to expect the price to normalize eventually. So the faster arbitrageurs can push the price back down to $1, the sooner the demand can rise again, leading to further increases in demand (up to a natural ceiling).

A professional arbitrageur is seeking to extract riskfree profits on a limited balance sheet, denominated in USD. Dai does not offer him any opportunities. The difference becomes clear when a buy order for 25M coins at a small premium comes to the market. For Dai, none of these people would open CDPs to create more Dai. In contrast, the same buy order on other stablecoins like USDT would generate an immediate supply increase, and arbers would sell the new supply to the buy order.

Because Dai doesn’t allow for professional arbitrage, this cycle will play out very slowly, if at all. While for USDC or USDT new supply generation is triggered whenever a buyer pays more than $1, the generation of more Dai relies on vague demand for more debt on the CDP side. What does this mean for Maker?

But… Maker is not primarily about the stablecoin

Dai’s disability to scale has no impact on Maker because that was never the goal, to begin with. Maker is a decentralized and very efficient version of centralized lending services like BlockFi, the primary use case of which is tax arbitrage:

“A loan from BlockFi enables you to use your cryptoassets as collateral and receive USD to your bank account. Borrowing against your cryptoassets enables you to receive liquidity now but does not trigger a capital gains tax event and, depending on the use of funds, the interest may be deductible against capital gains and other investment income.” (Source: https://blockfi.com/faq)

The two other prominent use cases are long leverage and treasury/payroll management for ICOs. The basic idea is always to generate liquidity *ahead of a future liquidity event* — spending money that you expect to receive later. Either from selling ETH after a tax deadline or from selling it at a higher price at a later time.

We believe Maker is a great service with a distinguished set of features. On the plus side, it offers lower friction, lower fees and less counterparty risk than centralized competitors and on the downside, lower maximum leverage, a lack of standard margin calls, and a steeper auto-liquidation penalty. It is the demand for Maker’s core product — lending — that will determine the supply of Dai in existence, not the other way around.

If the price of Dai goes over $1, that will generally incentivize people to take slightly more debt, especially those who already have CDPs open. But it will not incentivize anyone to make a CDP to arbitrage the difference, not unless he was already indifferent towards taking a debt. Since all money locked in CDPs have to come from a natural demand for debt, there is also a natural ceiling to the amount of debt that people are going to take, and hence for the amount of Dai that will exist.

In our opinion, there are three takeaways. First, because professional arbitrage is unprofitable for Dai, supply will not track demand as it does for other stablecoins. It follows that more demand for Dai will not lead to a meaningful increase in demand for ether as collateral, either. If anything, demand for ether as collateral might go down as Maker starts adding more assets and allows users to borrow against them instead of only against ether.

Second, Maker is often mentioned as a figurehead of Ethereum, usually as a driver for price bullishness. But we believe that Maker’s merit is less in “locking supply” and increasing demand for ether, which we showed is incorrect, and more about actual usefulness. Maker is proving that the Ethereum smart contract functionality can be used to create a highly efficient, decentralized version of BlockFi.

Last, it is now clear that too much attention was focussed initially on analyzing if Maker is a house of cards and Dai would hold the peg. The reality is it has survived a 90%+ decline in collateral value. This comes from a misunderstanding of the basic value proposition of Maker and Dai. It is not to create a scalable, censorship-resistant stablecoin. It is to be able to generate censorship resistant stability for anyone holding a volatile censorship resistant asset.

3 Replies to “Maker Dai: Stable, but not scalable”

I was scammed of $60,000 worth of bitcoin with a scam Forex investment unknowingly then I didn’t know what to do.. I felt like I should committed a suicide but I fortunately have a good start again until my friend introduced me to a Scam Recovery Site who helped me to recovered it for me in just few days, if you’ve been scammed by any fake forex /crypto currencies and binary options you don’t need to be worried you can also text them on christopheremmaunel842@gmail.com. and they will recover all your lost bitcoins or other currencies back… they are approved by government.

Bitcoin Recovery Testimonial

After falling victim to a cryptocurrency scam group, I lost $354,000 worth of USDT. I thought all hope was lost from the experience of losing my hard-earned money to scammers. I was devastated and believed there was no way to recover my funds. Fortunately, I started searching for help to recover my stolen funds and I came across a lot of testimonials online about Capital Crypto Recovery, an agent who helps in recovery of lost bitcoin funds, I contacted Capital Crypto Recover Service, and with their expertise, they successfully traced and recovered my stolen assets.

Their team was professional, kept me updated throughout the process, and demonstrated a deep understanding of blockchain transactions and recovery protocols. They are trusted and very reliable with a 100% successful rate record Recovery bitcoin, I’m grateful for their help and highly recommend their services to anyone seeking assistance with lost crypto.

Contact: Capitalcryptorecover @ zohomail. com

Phone CALL/Text Number: +1 (336) 390-6684

Email: Recoverycapital @ fastservice. com

Axiebet88casino, a mix of Axie fun and casino action. Could have more variety, but overall a solid spot. Ready to play? Click here: axiebet88casino